On Call International’s Monthly Risk Spotlight highlights events of heightened importance in assessing risk to travel and operations abroad.

Sub-Saharan Africa

Recent Attacks in Benin and Burkina Faso Increase Instability in the Sahel Region

In the past few months, terrorism in the Sahel region (mainly Chad, Burkina Faso, Niger, and Mali) has increased, putting the entire West African region on alert. The surge in terrorism has been the result of to two principal reasons – growing tensions between ethnic groups and clashes between farmers and herders. These two factors have led to increased terror attacks in the region, including in Burkina Faso and Benin, which has caused a high number of civilian casualties and destruction of properties, thus exacerbating poverty levels.

In April alone, more than 65 people were killed in ethnic clashes instigated by Islamist extremists in Burkina Faso. In May, French nationals Patrick Picque and Laurent Lassimouillas were kidnapped by terrorists in Pendjari National Park in Benin (which borders Burkina Faso, where Islamist terrorism has been on the rise). French forces rescued four foreign hostages, including U.S. and Korean nationals. The raids were conducted in the north of Burkina Faso when the kidnappers stopped en route to Mali.

By creating an unstable environment, Al-Qaeda is consistently building up its hold in the Sahel region. This has given rise to the fear that if terrorism is not curtailed in Burkina Faso, the country will soon become a launch pad for terrorists to exert influence on West Africa’s coast. Notably, Burkina Faso has witnessed more than 200 attacks in three years. The violence has spread quickly in Burkina Faso, disturbing the equilibrium between Muslim and Christian communities. As a result of terrorism, more than 100,000 people from Burkina Faso have been displaced in the past few months.

The escalating terrorism has prompted the United States to fund training for law enforcement units in Burkina Faso. The African Union and other Western powers have realized that military and security response mechanisms alone are not enough to curtail the growth of terrorism. Holistic development, including improvement of social indices, especially falling employment rates, is essential to the country’s social and political upliftment. Additionally, Burkina Faso, Chad, Mali, Mauritania, and Niger had also set up a G5 Sahel joint force in 2017 that aimed to train its troops alongside the French forces. However, lack of proper funding, training, and equipment have stunted the initiatives of this G5 force. With the current military strategies (including troop cuts by the U.S.) not working in favor of controlling terrorism, there is a heightened risk of escalating attacks and instability in the region – an aspect that also threatens all of West Africa and beyond.

Middle East and North Africa

Escalation of Tensions between the U.S. and Iran Creates Risk for Commercial Activities

In May 2019, tensions escalated between the U.S. and Iran following a series of incidents. The United States has imposed sanctions on countries buying oil from Iran, and increased military readiness in the Middle East. Iran has responded by threatening to arm proxies and close the Strait of Hormuz. However, some developments have raised the specter of an intended escalation. On May 14, in an alleged ‘sabotage act’ the U.S. intelligence attributed to Iran – four shipping vessels were damaged in the Gulf of Oman, in UAE’s territorial waters. Two days later, the Iran-aligned Houthi militia in Yemen claimed responsibility for a drone strike on oil pumping stations in Saudi Arabia.

Increased tensions in the region have been a fall-out of the Trump administration’s May 2018 decision to unilaterally walk out of the Iran nuclear deal that had been signed by the five members of the Security Council as well as Germany and Iran. The renewed U.S. sanctions have impacted Iran’s oil exports and investment plans, affecting critical economic indices. According to the International Monetary Fund, Iran’s economy contracted about 4% in 2018. Inflation rose by 50%, and Iran’s currency, the rial, has faced consistent pressure. This impact was particularly visible during the recent floods in Iran, where the country was unable to receive foreign aid due to restrictions on its financial sector.

In the background of these developments, pressure from hard-line groups has increased on Iranian PM Hasan Rouhani to retaliate against the U.S. sanctions and the increasing U.S. military presence aimed to contain Iran. In early May 2019, Rouhani announced Iran would start taking steps to decrease its adherence to some of the provisions of the Iran deal. A recent U.S. Intelligence report also stated Iran is building up its proxy forces to target U.S. interests and commercial shipping routes in the region.

The U.S. response has been a combination of increasing Iran’s economic isolation and its force strength in the region. In May, tensions seem to have further empowered the Trump administration’s hard-line lobby to call for measures that have alarmed members of the U.S. Congress. On May 24, President Trump used an emergency legal loophole to move ahead with the sale of weapons to Saudi Arabia, citing threats from Iran. The administration also announced that it would deploy 1,500 additional personnel to the Middle East, including fighter jets, reconnaissance and surveillance aircraft, and a battalion of Patriot Missiles.

In light of this military build-up and recent incidents in Saudi Arabia’s Gulf of Oman, the recent rocket attack in Iraq could have unintended consequences. After the initial reactions, most sides have tried to downplay the incidents to avoid escalation of tensions. Iran condemned the attacks as ‘dreadful’ and has called for a full investigation. On May 25, President Trump clarified the speculations regarding the increase in troop strength and sanctioned deployment of the 1,500 personnel, mostly ‘protective troops.’ This was much less than the 20,000 forces U.S. commanders in the region had sought. While the pressure on President Trump from the hard-liners will continue, his position of disengagement from conflict zones in the Middle East and pressure from the U.S. Congress can help keep a balance. For Iran, struggling with economic woes and widespread protests, an increase in tension with the U.S. to the point of no-return is likely to be avoided.

However, these incidents have raised the possibility of unintended escalations in the region and their impact on commercial activities. The Gulf of Oman incident, particularly, has raised concerns regarding how culprits can exploit the distrust between the main stakeholders to further escalate tensions and empower hard-liners.

Asia Pacific

Moving the Capital from Jakarta: Political Gimmick or a Feasible Option?

The megacity of Jakarta has a host of issues including pollution, overpopulation, and traffic that costs the city USD $7 billion a year in productivity. Another major problem is that the city is one of the fastest-sinking locations in the world and suffers from other natural calamities. Researchers say large parts of Jakarta could be submerged by 2050. For these reasons, along with his plans for spreading development beyond the island of Java (where 60% of the Indonesia population lives), President Jokowi recently raised the question on social media of shifting the capital from Jakarta and invited suggestions for alternative locations.

The Indonesian government has three primary options:

- Move the national capital completely, similar to how Brazil shifted its capital from Rio de Janeiro to Brasilia in 1960.

- Create a separate administrative center and leave Jakarta as the official capital, similar to the Malaysian experiment in Putrajaya and Kuala Lumpur.

- Leave Jakarta as the capital and administrative center.

For a potential new capital, the island of Kalimantan is considered the most suitable, with its vast land area, safety from earthquakes and volcanic eruptions, and distance from Singapore and Malaysia. Palangkaraya, in central Kalimantan, is a favored location.

Wikimedia Commons

Wikimedia Commons

As of now, Indonesia’s planning minister, Brodjonegoro, has said the new capital would be strictly administrative; Jakarta would remain Indonesia’s economic and business epicenter. Considering this, it is unlikely that Jakarta’s large business sector and wealth would go to a new city. Since government activities only contribute about 10% of Jakarta’s burden, the new capital (presumably designed to host 900,000 to 1.5 million people) is also unlikely to substantially reduce Jakarta’s woes.

The Indonesian government estimates this plan will take at least 5-10 years to come to fruition and may cost USD $33 billion. However, one Jakarta-based urban economist told ABC, that “moving capital cities carries major hidden costs, has little impact on the congestion or growth rate of the original city, and historically takes 50 to 150 years to establish a fiscally viable municipality.”

The idea of shifting capitals is one that has been prevalent since Indonesia’s colonial occupation. When Jokowi touted the plan two weeks after the presidential election, skeptics thought it was meant as a ploy to distract from the contested nature of the elections. But in early May, he gave structure to this idea by ordering the cabinet to develop a finance plan for the relocation, which would include private investors to foot the bill. He has also specifically requested the National Development Ministry to conduct a feasibility study for the relocation plans.

Several challenges, however, are likely to hamper this endeavor, first being the resistance from key stakeholders such as the business community and civil servants. It is also unlikely to solve Jakarta’s problems or affect its status as an economic and business center. With business and commercial activities concentrated in Jakarta, setting an administrative capital on another island that also has water resources and is free from pollution, environmental hazards, and conflict would be a difficult task.

Europe and Central Independent States

Spanish Elections: Despite Gains by Socialists, the Task of Coalition Building Will be Difficult

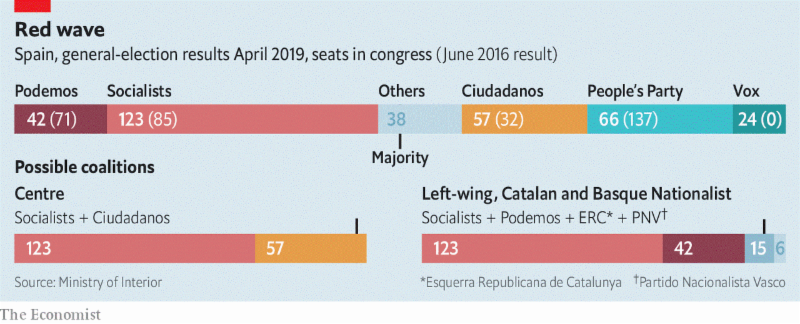

The general elections in Spain held on April 28 delivered both continuity and change. While the fragmented nature of the vote and its impact on fortunes of the many political parties continues, the elections delivered what the Economist called a ‘rare good result for European social democracy.’ After a year of uncertainty, Socialist party PSOE led by Pedro Sanchez got 123 out of 350 seats in the Congress, giving it a fighting chance to form a workable coalition. The Nationalists and the separatists also made gains, especially the Catalan separatists. The far-right Vox party has entered the parliament for the first time.

The subsequent European regional and local elections on May 26 have reinforced these trends of fragmentation. The task of coalition building and policy formulation is thus likely to continue to be complicated. In the European parliamentary elections, the socialists again did well, which is expected to give them greater negotiating power with other parties to form the government at the national level. However, with Spain, the natural partners of PSOE – Podemos and Independentists – do not add enough seats to help form the government. In addition, the right-wing parties added wins on May 26 and still continue to govern important regions and municipalities of Spain.

The election results are likely to impact two significant issues in the country – the future of the autonomous region of Catalonia and the rise of the right-wing party Vox. Two electoral equations will have an impact on the Catalan issue, less than two years after the Catalan separatists declared independence from Spain in October 2017. The first is the increase in the number of seats for the Catalan separatists in the backdrop of a fragmented parliament. This means the new (possibly minority) government will have to depend on the Catalan separatist votes or abstention for passing major laws. Second, the electoral drubbing of the Popular Party (PP), the main opposition party, has led the Popular Party to take a U-turn on the issue. From advocating a suspension of Catalonia’s self-rule status, PP leader Casado has announced the party will open up a permanent communication channel with Sanchez’s PSOE. However, with the uncompromising stance of right-wing parties, the status of the trials of the four elected Catalan separatist MPs continues as it is. The parliamentary authorities are expected to suspend all four Catalan separatist MPs on the urging of PP, Ciudadanos, and the Vox.

Today, the Spanish parliament is more fragmented than it was in 2016 due to the Vox Party’s entry. The party created ripples in Spanish politics with substantial gains in the Andalusian regional elections in December 2018, where they enabled the formation of a non-socialist government for the first time in 36 years. In the national elections, with 24 seats and 10.3% of the vote, it did well but fell short of many forecasts. However, the appeal of the Vox is likely to increase in the near future. One of the reasons for less-than-expected performance was that the popular vote was spilt between three parties (PP, Ciudadanos, and Vox), espousing right-wing ideology in varying degrees. The ‘threat’ of Vox also allegedly helped PSOE to mobilize its supporter base, which resulted in a high turnout. Despite this, the fortunes of the Vox are likely to grow, especially if the PP and Ciudadanos opt to do deals with the party at the regional and local levels.

Americas

Cuba Mired in Economic Crisis as the U.S. Imposes New Sanctions Against It

In April 2019, U.S. President Donald Trump imposed a new set of sanctions on three countries – Cuba, Venezuela, and Nicaragua. The sanctions were communicated by American National Security Advisor John Bolton to the veterans of the failed 1961 Bay of Pigs invasion. Notably, the sanctions were the most severe for Cuba – the U.S. blames Russia, Cuba, and others for the unsuccessful ousting of Venezuelan President Nicolas Maduro. At this juncture, the U.S. feels Cuba’s intelligence and security support is helping Maduro’s grip on power despite a severe economic and political crisis in Venezuela. The sanctions on Cuba entail the following:

-

-

- Limits on the amount of money Cuban Americans can send back to Cuba.

- Invocation of Title III of the Helms-Burton Act that has invited the criticism of Canada and several European nations. The Act (that was waived for the past 23 years) will allow any U.S. citizen (including Cuban Americans) to sue any foreign company that uses any land nationalized by the Fidel Castro government after the 1959 revolution. Barring the Cuban elite (around 1 percent who fled Cuba to the U.S. after Fidel Castro came into power), the decision is a major setback for several companies operating in Cuba. The decision, aimed to pressure Cuba to withdraw support from Venezuela, will result in billions of dollars of lawsuits impacting European and Canadian companies’ operations in sectors such as hotels, distilleries, tobacco, etc.

- Non-family travel restrictions for American citizens – already in 2017, the Trump Administration ceased the ‘people to people policy’ and stated only Americans on an educational tour could travel to Cuba. Also, Americans could not stay in or shop from government-owned hotels and shops in Cuba. Under the current sanctions, the U.S. government is yet to clarify the extent of the travel restrictions re-imposed on Americans.

-

Currently, there is a risk of legal exposure for international companies operating in Cuba due to the activation of Title III of the Helms-Burton Act. The suspension of the Act has already ceased on May 2. Hence, companies that have ‘taken’ or ‘are in the process of taking’ properties in the last two years would immediately be exposed to claims from individuals and companies. With the activation of Title III, Title IV could possibly pass. If passed, Title IV involves restriction of entry of any foreign national into the U.S, including spouses and children, who have ‘trafficked’ or are ‘trafficking’ confiscated property in Cuba.

However, despite the strict sanctions, Cuba has scaled up efforts to attract tourists and boost its tourism sector in order to sustain itself in one of the worst economic crises in two decades. In fact, the Cuban government has charted out a plan to attract five million tourists in 2019. It will take a few more months to ascertain the aftermath of the sanctions and whether the Cuban government’s plan can steer the country out of economic crisis.

Need help assessing the global risks affecting your travelers? Contact us today.